Company Background:

Grape Capital Group (GCG) is an ethical private lender that specializes in second mortgages. Based in downtown Toronto, the company works with independent mortgage brokers to help responsible homeowners unlock the equity in their home.

Project Summary & My Contribution:

I helped lead a team of designers to update the GCG brand. I was involved with everything from helping synthesize research, helping create a new brand strategy, and executing on various collateral including a responsive, mobile-friendly website, brand guidelines, stationary, etc. I was partly responsible for presenting the creative work and ensuring the concept was communicated effectively.

Challenge:

GCG approached us with two asks; First, they asked for help defining and acting on their brand values. Second, they asked us to update their brand to reflect those values and attract reputable, trustworthy brokers. From early on in the project, it was clear they also aimed to de-stigmatize second mortgages for borrowers.

"Help us show people we're a second mortgage lender people can trust".

Research:

First, we enlisted the help of the Ipsos research to gain a better understanding of how second mortgages are perceived, among other things. We supervised as Ipsos interviewed brokers and borrowers who have used a second mortgage during financial hardship.

Our research also included an extensive competitor analysis that analyzed visuals and language. What we found was truly disheartening. In general, most other mortgage lenders used predatory tactics and misleading information to take advantage of people with financial hardships. To our surprise, we even came across second mortgage terms that charged higher interest than the average credit card, making it darn near impossible for someone to pay off their loan in a reasonable amount of time.

Key Findings:

From this research, two things were clear:

- Second mortgages are stigmatized. To brokers, they are perceived as more trouble and more work than first mortgages. To borrowers, they are seen as a last resort.

- Knowledge of how second mortgages work is low. This, combined with feelings of fear and shame puts power and influence in the hands of a broker. This power goes largely unchecked.

Key Audiences & Personas:

We had two key audiences to address, the broker and the borrower. We were mostly focused on the broker. Legally speaking, GCG is only able to make deals with borrowers through licensed brokers, never directly with borrowers. That said, we knew that some borrowers—unaware of these legal processes—could stumble upon GCG and we didn’t want to ignore the audience entirely. In fact, GCG wanted to find an opportunity to educate the borrower, empower them with the knowledge they need to ask the right questions and to keep their brokers honest, addressing our research insights head-on. Based on all of our research up until this point, we created four broker personas with varying degrees of knowledge of GCG and four borrower personas. We mapped potential customer journeys to pinpoint areas where the GCG brand could improve in communication and in reach.

Strategy:

Armed with research and using our personas to empathize and “gut check” along the way, we examined the pain points along their journeys. We realized that if second mortgages represent shame, GCG had an opportunity to challenge this notion and bring respect back into the interaction.

Respect for borrowers, brokers, second mortgages, the industry, and also regulation.

With this new direction on positioning, we got to work on creating visuals to reflect respect. I started by researching stress and how it hijacks the nervous system. I read scientific studies explaining how when someone is in a stressful situation, their focus narrows and they adopt a simpler form of processing information. I knew that meant we needed to focus on keeping our solutions—visual or otherwise—as simple and clear as possible. In other words, I knew that whatever we did, we needed to reduce the cognitive load for any type of message to stick.

From a broker perspective, we aimed to be a source of knowledge and communicate that GCG is only interested in low-risk loans for qualified borrowers. We also aimed to use language that implies that GCG isn’t interested in “shady deals”, or any sort of deal that would cause the borrower more financial hardship.

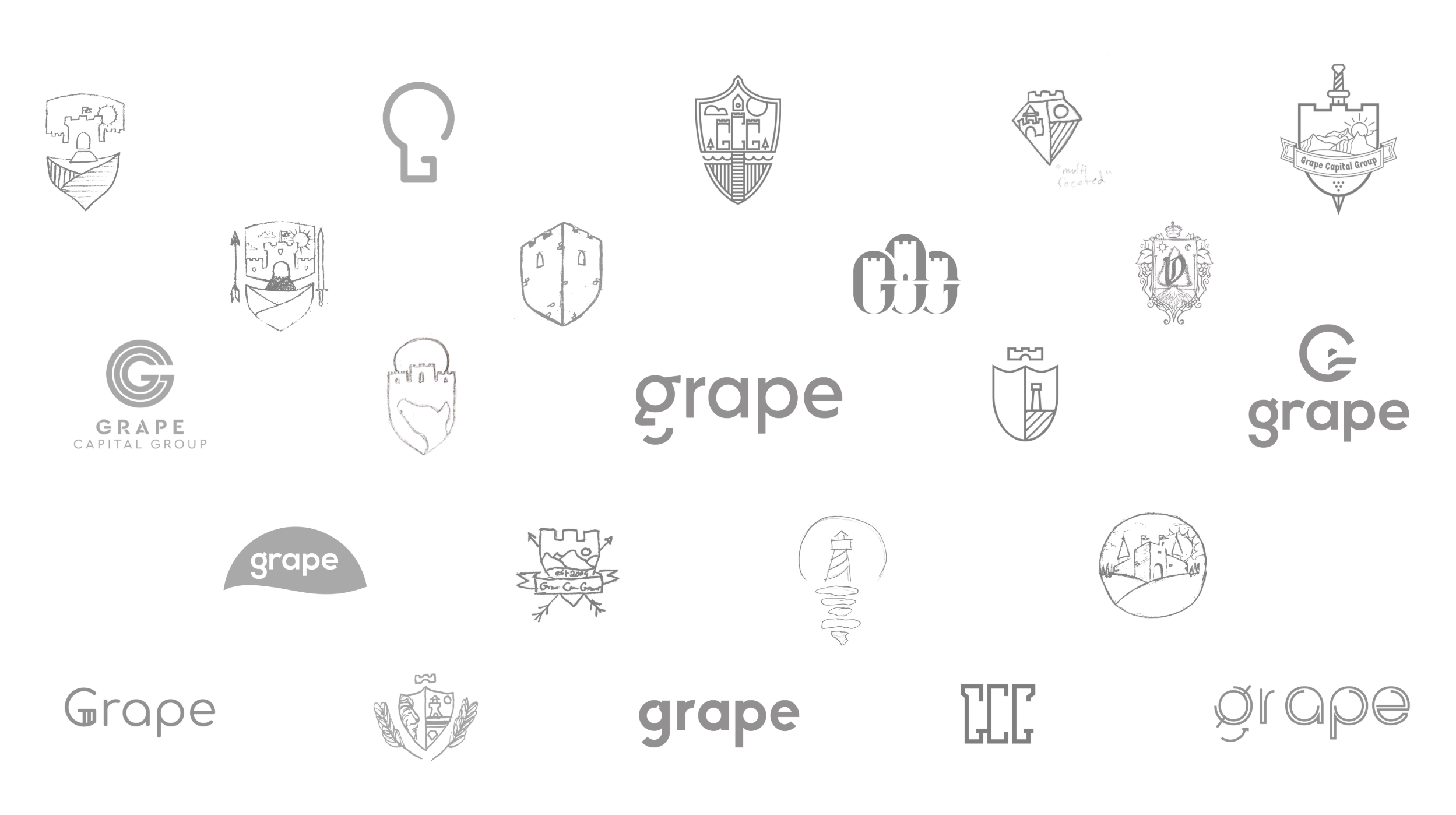

Visual Exploration:

Throughout the logo ideation process, we explored many different ideas and approaches through hands-on brand exercises with the client and challenged our designers (myself included) to explore various creative avenues. Countless logos were created. Some were inspired by GCG’s family history or finance; some by the emotions we aimed to evoke. In the end, the direction that resonated was a logo that featured lots of symbolism to reference these strong values. There are three castles built within the brand’s acronym (GCG). The castles symbolize security and trust. The open door implies kindness and transparency, for example.

Execution:

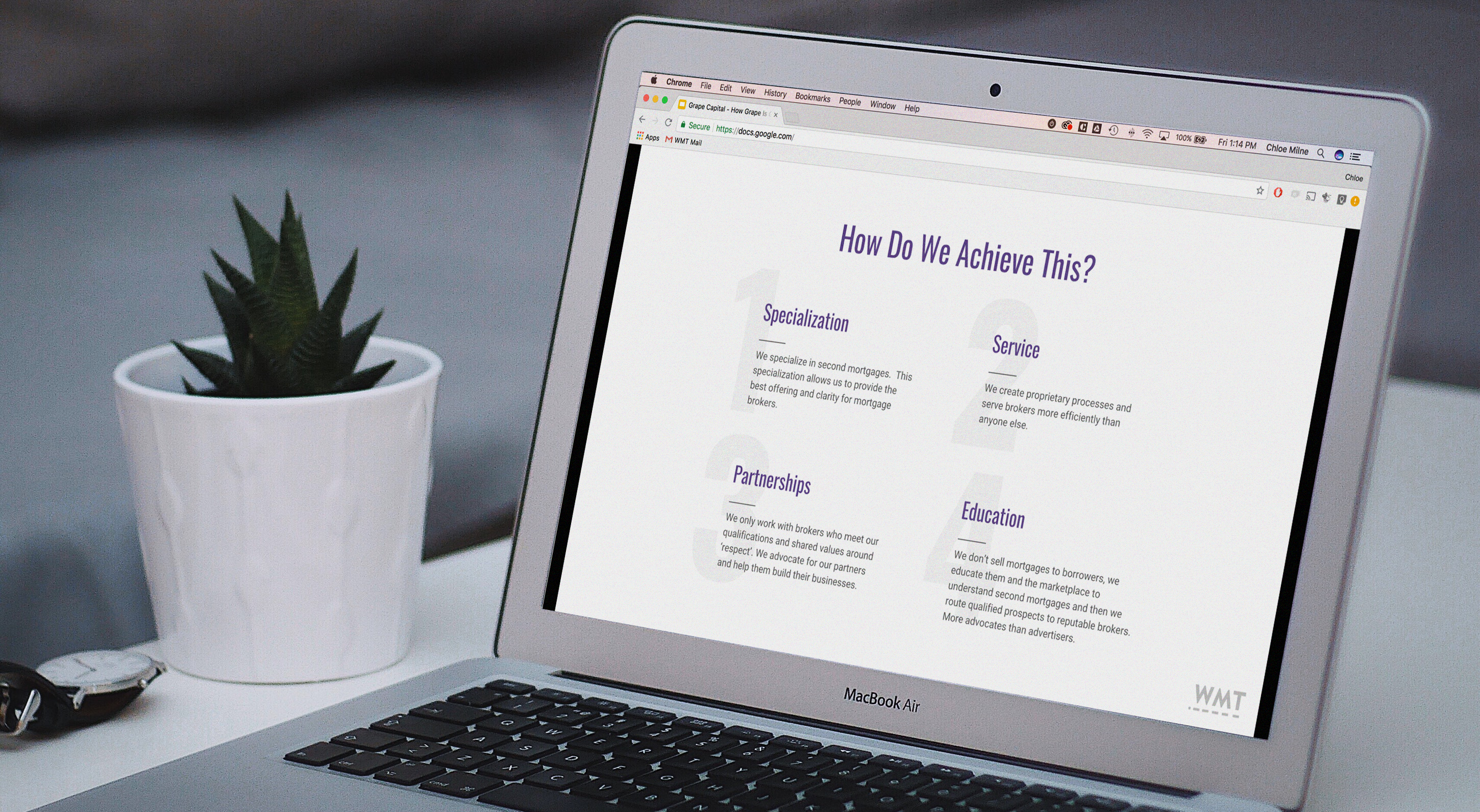

Using our personas and customer journeys, we highlighted key areas for improvement and proposed a number of solutions to address the research insights and improve their brand. One of these solutions included an updated website.

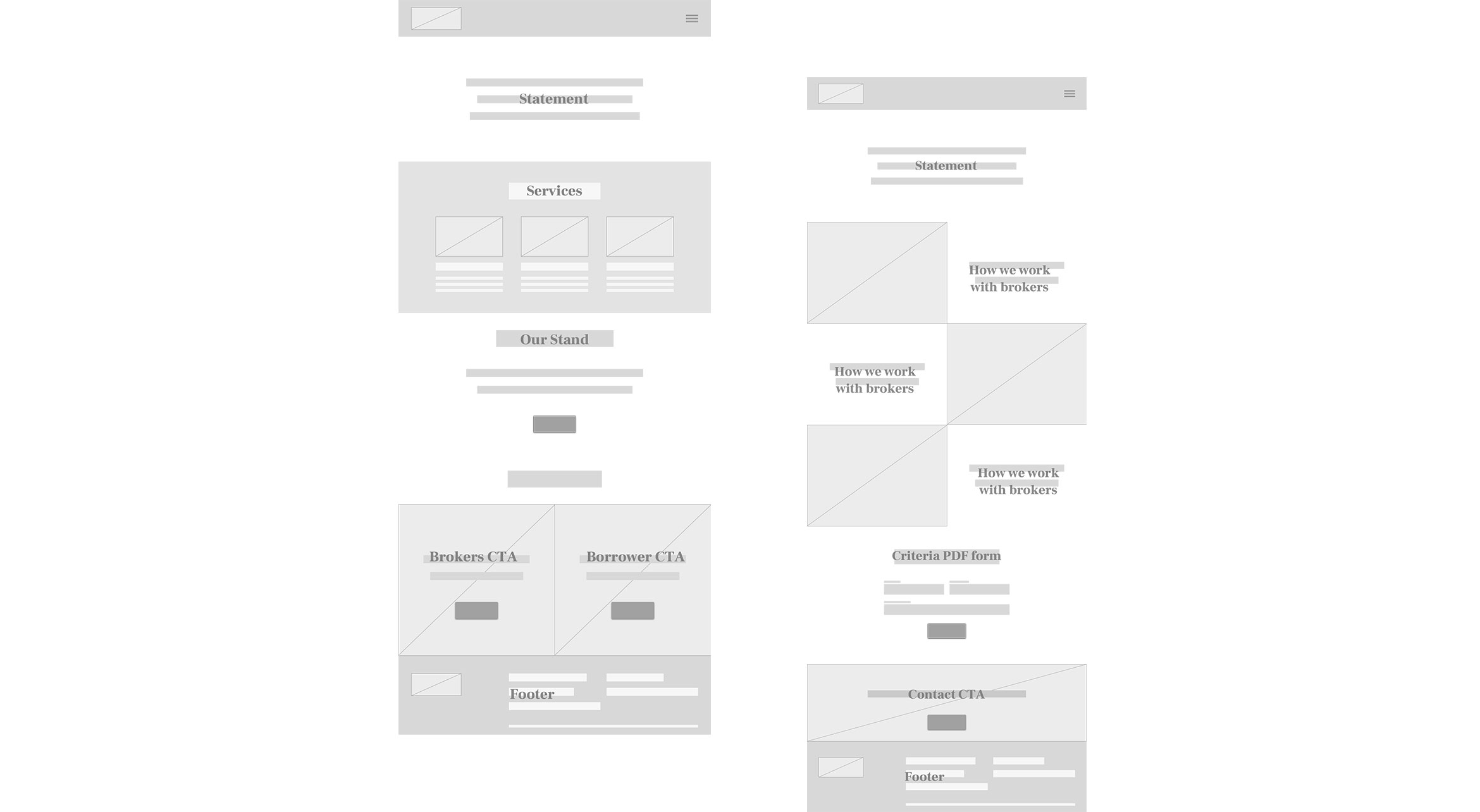

Low Fidelity Wireframes:

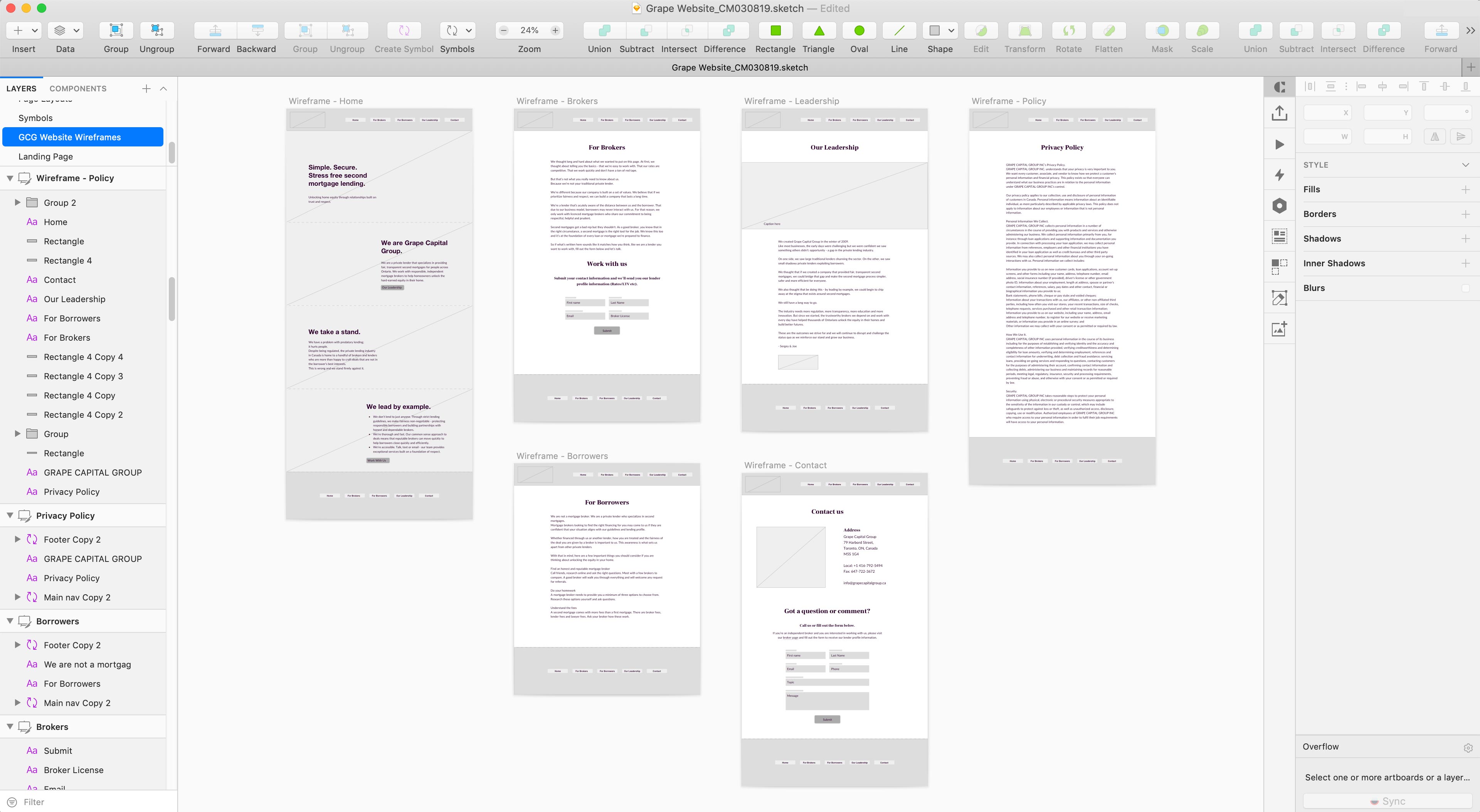

High Fidelity Wireframes:

Finished Product:

Knowing that the client responded well to visuals and rationales with depth, we approached the first round of design with a multi-layered rationale. Frequently, the client had referenced GCG as their home and wanted to form lasting relationships with their brokers by “inviting them to our table for dinner”. We knew instinctively that their website needed to reflect that sense of home, so we explored making the background of the site look like the walls of their home. We worked closely with the client during this time, choosing objects for shelves that further reinforced the symbolism they were tied to. We were able to subtly reference the main visual in their industry (homes) without being cliché.